Recently, a question was posed to me about the advancement of technology in the housing finance industry. The question was based upon a few paragraphs from a recent news blast by the National Council of State Housing Agencies (NCSHA).

(And before I get much further, let me acknowledge this post won’t be a typical post for the Levaire blog. Stay with me. I’ll bring it home; promise.)

The NCSHA paragraphs in question:

One major driver of disruption across these areas, which Mehlman forecasts will continue its astonishing acceleration, is technology.

What does it mean for housing? Craig Phillips, counselor to U.S. Treasury Secretary Mnuchin, alluded to one important domain in his remarks at that same NCSHA board meeting: the rapid growth of nonbank financial (“fintech”) firms. Phillips cited Treasury’s report released last summer, “Nonbank Financials, Fintech, and Innovation,” which includes more than 80 recommendations to Congress and bank regulators.

The Treasury report notes that while the housing finance industry “has been slow to adopt innovations common in other consumer credit markets…the application of financial technology in the mortgage market is accelerating, challenging existing norms as the industry transitions toward automated, digital practices and processes that appeal to customer demands in today’s digital age.”

The question was, “Really? Been slow to be technologically savvy with mortgages?” It was a question of disbelief, as the evidence of mortgage calculators, online applications and automated eligibility tools seems ubiquitous in this market.

My response was complete agreement, however. For this industry and others, I believe the adoption of technology has been slow, but I think the question can only be answered by looking at where technology is going globally; not by looking at a single industry.

Just as we can’t see how large a forest is by standing in the middle of it, we won’t be able to glean an accurate perspective of an industry’s technological pace by only looking at the industry itself.

What Might the Future Hold?

I think the bleeding edge here looks like artificial intelligence (AI)-enhanced vetting and blockchain contractual/financial transactions, which are still in their infancy. Give it a couple years. As the lines between individual privacy, identification (for the US, this means Real ID by 2020, but we’re certainly trailing in the lemming line behind countries like Estonia and Sweden), banking, credit, EMR, retail and Lord-only-knows-what-else continues to blur, I think we’ll see a quickening.

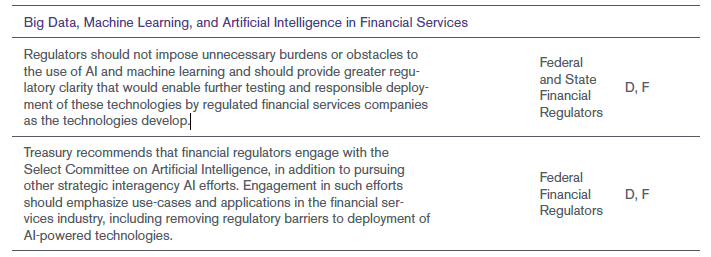

Initially, I think this movement will be pitched under language that looks like the 10th recommendation in Treasury’s document, per Appendix B, page 198: “standardization of data elements as part of improving consumers’ access to their data.”

Translation: We’re doing this for our beloved customers.

Oh, and AI? That’s on page 200:

Translation: We want an open door.

In respect to housing, I think we’ll eventually see mortgage transactions opened and closed within moments; not weeks or months.

Once all your financial, medical and otherwise personal history is “blockchained” to your bodily person, an AI-driven decision based on your social credit score should be pretty easy (but social credit scores are only in China, right?)

Though this NCSHA article points to slow movement by the financial industry, I’m sure Citi and Chase are planning 20-30 years ahead or more, which easily puts them 10-15 years ahead of most state and local governments.

On that note, back around 2005, I was sitting down to lunch with a government sales rep from Intel when he told me Intel had their eyes on wifi-speed cellular towers. Fast-forward to today, this technology is currently being rolled out under the ‘5G’ moniker and is a key component in the encroaching Internet of Things (IoT).

Bringing It Home

As blockchain and AI improves and infiltrates with the help of quantum computing (Dan 12:4), I think innovation will be led by private-sector (yes, even the financial industry,) fueled by a mix of global competition on the world stage, targeted government contracts and a race toward the gold of data-mining and consolidation.

Then we simply add a dash of cashless society (Rev 13:17), a teaspoon of deep-state bio-metric surveillance (Rev 13:16) and sprinkle a some CRISPR-ish gene-editing (Rev 9:6) to taste.

Sounds like some loose-nut conspiracy theory, right? If these events weren’t unfolding before our very eyes, I mean.

We are in a time of convergence. Eyes and ears open, folks.